ETH Price Prediction: Bullish Momentum Builds Amid Institutional Demand

#ETH

- Technical Strength: ETH trades above key moving averages with narrowing bearish momentum

- Institutional Demand: Record ETF inflows and corporate treasury allocations signal long-term confidence

- Ecosystem Growth: Upcoming MetaMask stablecoin and developer activity reinforce network utility

ETH Price Prediction

ETH Technical Analysis: Bullish Signals Emerge

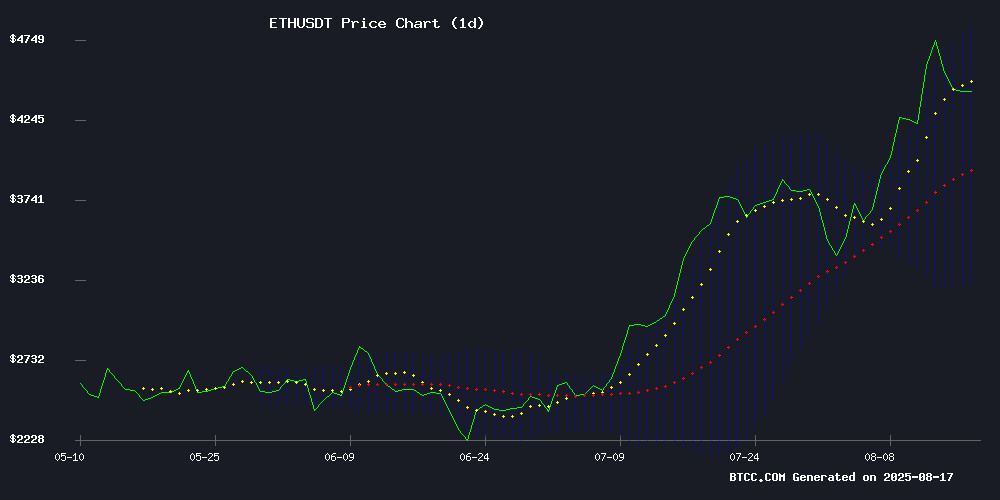

According to BTCC financial analyst Ava, ethereum (ETH) is currently trading at $4,463.37, above its 20-day moving average (MA) of $4,028.15, indicating a bullish trend. The MACD histogram shows a narrowing bearish momentum, while the price hovers near the upper Bollinger Band at $4,846.54, suggesting potential upward movement if resistance is breached.

Market Sentiment Turns Bullish for Ethereum

BTCC financial analyst Ava highlights strong positive sentiment driven by institutional interest, with headlines like 'Ethereum Price Prediction at $7,500' and record ETF inflows. Strategic accumulations by BitMine and BTCS, alongside MetaMask's upcoming stablecoin launch, further bolster ETH's long-term prospects.

Factors Influencing ETH’s Price

Ethereum Price Prediction at $7,500—Ozak AI’s ROI Potential Looks Much Higher

Ethereum continues to dominate as the backbone of decentralized finance (DeFi) and Web3 ecosystems, powering a vast array of decentralized applications, NFT platforms, and smart contracts. Analysts project a bullish trajectory for ETH, with a potential price target of $7,500 by 2025. This would mark a 150% gain from current levels, pushing Ethereum's market capitalization beyond $900 billion.

Layer-2 scaling solutions like Arbitrum, Optimism, and zkSync have significantly enhanced network efficiency, reducing transaction costs and increasing throughput. These advancements, coupled with the expanding DeFi and NFT markets, solidify Ethereum's position as the cornerstone of the blockchain economy.

While Ethereum's projected returns are substantial, early-stage projects such as Ozak AI promise even higher ROI for investors willing to take on greater risk. The contrast between large-cap stability and small-cap potential underscores the dynamic opportunities within the crypto market.

BitMine Expands Ethereum Holdings to $5.77 Billion in Strategic Accumulation

BitMine has fortified its Ethereum reserves with a $600 million purchase of 135,135 ETH, executed through institutional platforms FalconX Global, Galaxy, and BitGo. The treasury firm now holds 1.297 million ETH, cementing its position as a dominant institutional holder.

The acquisition underscores institutional conviction in Ethereum's long-term value proposition. BitMine's reserve strategy mirrors growing corporate adoption of crypto assets as treasury instruments, with ETH emerging as a preferred alternative to traditional reserves.

ETH Spot ETFs Set for Record Inflows Amid Surging Demand

U.S. spot Ether ETFs are on track for a historic month, with net inflows surpassing $2.9 billion in the first half of August alone. This week has emerged as the strongest since the products' launch, highlighted by a single-day influx of over $1 billion—the highest daily figure recorded.

Ether's price rally mirrors this demand, briefly nearing its all-time high at $4,784 before stabilizing above $4,600. The surge has propelled total assets under management in ETH ETFs to a record $29.22 billion, signaling robust institutional interest.

If current trends hold, August could eclipse July's $5.43 billion inflow record. Market observers attribute the momentum to growing confidence in ETH's long-term value proposition and broader crypto market recovery.

BTCS Expands Ethereum Treasury to $321M Amid Revenue Surge and Strategic Losses

BTCS Inc. has aggressively expanded its Ethereum holdings to 70,140 ETH ($321 million), signaling deepening institutional conviction in the asset. The blockchain-focused firm plans to raise $2 billion to further amplify its crypto treasury position.

First-half 2025 revenue skyrocketed 341% to $4.46 million, yet the company absorbed a $13.39 million net loss. Strategic investments in Builder+ gas optimization technology and $5.74 million in depreciation charges weighed on profitability.

The divergence between revenue growth and net losses underscores BTCS's calculated bet on Ethereum's infrastructure evolution. 'We're playing the long game in layer-2 efficiency,' the earnings report implied without direct attribution.

Coinbase Flags Early Signs of Altcoin Season as Institutional Interest Grows

Market analysts at Coinbase Institutional are detecting early signals of a potential altcoin surge, with September poised as a pivotal month. Ethereum has emerged as the primary beneficiary of institutional allocations, with corporate treasuries rapidly accumulating over two million ETH since June. Entities like Bitmine, SharpLink, and Bit Digital are leading this charge, driven by narratives around stablecoins and digital asset treasury management.

Liquidity conditions are rebounding after six months of decline, with Coinbase data showing improved trading volumes, order book depth, and stablecoin issuance. The shift follows a more favorable regulatory environment, encouraging market makers and long-term participants to re-engage. This liquidity recovery could serve as a catalyst for sharper altcoin rallies if current momentum holds.

Derivatives markets are flashing signs of an impending altcoin rotation, with open interest dominance shifting away from Bitcoin. The convergence of macro trends, regulatory clarity, and institutional positioning suggests the next few months may see decisive capital flows into alternative cryptocurrencies.

Surge in Ethereum ETF Inflows Showcases Renewed Market Interest

U.S. spot Ethereum ETFs recorded net inflows of $639.6 million on Thursday, extending an eight-day streak of positive momentum. BlackRock's ETHA dominated with $519.7 million, while Grayscale and Fidelity products followed with $60.7 million and $56.9 million, respectively. Cumulative inflows over this period now stand at $3.71 billion.

Despite the ETF rally, Ethereum's price dipped 2.03% to $4,655, reflecting a temporary decoupling between investment products and spot market performance. The surge began with Monday's record $1.02 billion inflow, signaling institutional appetite for crypto exposure through regulated vehicles.

Ethereum Price to Eye All-Time High, Amid Short Squeeze Risk

Ether dipped 2.23% to $4,632.79 amid broader crypto market weakness, though weekly gains remain robust at 18.65%. Derivatives markets show mounting pressure, with $800 million in liquidations across crypto assets—including $50 million in ETH long positions—as open interest surged 16% to $895 billion.

Analysts flag a potential inflection point at $4,872, where over $2 billion in leveraged shorts on Binance, OKX, and Bybit could trigger a violent squeeze. "Historically, these setups precede explosive rallies," says market analyst Peter Brandt, noting that a breakout could propel ETH past its previous record into uncharted territory.

Additional headwinds emerged as Turkish exchange BtcTurk halted withdrawals following a $48 million security breach involving suspicious ETH transfers. Yet the market's focus remains fixed on whether institutional momentum can override near-term profit-taking.

Standard Chartered Raises Ethereum Price Target to $7,500 on ETF Inflows and Stablecoin Growth

Standard Chartered has significantly upgraded its Ethereum price forecast, now projecting ETH to reach $7,500 by end-2025—a near doubling from its previous $4,000 estimate. The bullish revision follows record ETF inflows and accelerating institutional adoption.

Ethereum-based investment products have absorbed 3.8% of circulating supply since June, outpacing Bitcoin's accumulation rate during the 2024 U.S. election cycle. This demand shock propelled ETH within 4% of its all-time high as U.S. spot ETFs crossed $1 billion in inflows.

The bank attributes sustained momentum to regulatory clarity from July's GENIUS Act and Ethereum's dominance in stablecoin issuance. With stablecoins generating 40% of blockchain fees and the market poised to grow eightfold to $2 trillion by 2028, ETH stands to capture disproportionate value.

Technical upgrades loom large in the thesis. Vitalik Buterin's roadmap promises 10x layer-1 throughput improvements, potentially cementing Ethereum's position as the settlement layer for high-value transactions while offloading volume to L2 solutions.

Google Tightens Cryptocurrency Wallet Policies on Play Store Amid Regulatory Shifts

Google has enacted stringent new requirements for cryptocurrency wallets listed on its Play Store, mandating FinCEN registration or MiCA compliance for developers. The move follows heightened regulatory scrutiny in both the U.S. and EU markets.

Non-custodial wallet providers must now implement AML/KYC measures, a shift that contributed to ETH's $70 price drop. The policy explicitly targets unlicensed operators, stating developers must either hold money transmitter licenses or banking charters in the U.S., or CASP authorization under MiCA in Europe.

This development signals growing institutional alignment with financial regulations, potentially accelerating crypto's mainstream adoption while eliminating unregulated market participants. Market reactions suggest short-term volatility as the sector adapts to these compliance-driven changes.

MetaMask to Launch Proprietary Stablecoin mUSD in Partnership with Bridge and Blackstone

MetaMask, the dominant Ethereum wallet with over 30 million monthly active users, is poised to unveil its dollar-pegged stablecoin mUSD this week. The token will go live by month-end following a prematurely leaked governance proposal last week.

The Consensys-owned wallet collaborates with Stripe-acquired fintech Bridge for payment rail integration and stablecoin protocol M^0 for issuance. Blackstone provides treasury management and custody services—a rare institutional endorsement for crypto-native projects.

This move aligns MetaMask with crypto platforms holding substantial user funds in established stablecoins like USDT and USDC. The self-custodial wallet's foray into stablecoin issuance signals deepening infrastructure maturity in decentralized finance.

Ethereum Core Developer Zak.eth Loses Funds to Malicious VS Code Extension

Ethereum core developer Zak.eth fell victim to a sophisticated supply chain attack after installing a malicious VS Code extension disguised as a legitimate Solidity development tool. The "contractshark.solidity-lang" extension, which had accumulated over 54,000 downloads and appeared in Cursor's default registry, compromised Zak's wallet by exfiltrating private keys from his .env file.

The attacker drained funds three days after initial infection, though Zak limited losses to a few hundred dollars through prudent use of hardware wallets. "If it can happen to me, it can happen to you," warned the developer, whose decade-long security streak was broken by the JavaScript-based exploit that bypassed traditional malware detection.

This incident forms part of a broader $500,000 campaign targeting cryptocurrency developers through compromised development tools. The attack vector exploited trust in official registries and the credibility conferred by high download counts, highlighting growing security challenges in blockchain development ecosystems.

Is ETH a good investment?

Ethereum presents a compelling investment case based on both technical and fundamental factors:

| Metric | Value | Implication |

|---|---|---|

| Price vs 20-day MA | $4,463 > $4,028 | Bullish trend |

| MACD Histogram | Converging | Bearish momentum fading |

| Bollinger Band Position | Upper band at $4,846 | Potential breakout |

Institutional accumulation and ETF inflows suggest growing confidence in ETH's $7,500 price target.

1